This is part of a series of posts inspired by CFSI’s Underbanked Financial Services Forum. At the conference, attendees were asked to complete the sentence, “in the future, the underbanked marketplace will…” on a square button.

This is part of a series of posts inspired by CFSI’s Underbanked Financial Services Forum. At the conference, attendees were asked to complete the sentence, “in the future, the underbanked marketplace will…” on a square button.

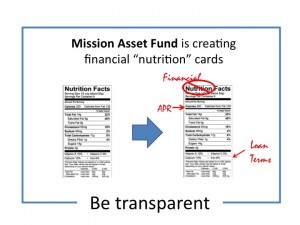

Clearly transparency in financial products is paramount, today and moving forward. And not just the fine print. Mission Asset Fund has proposed creating financial nutrition cards, modeled on the FDA required Nutrition Facts found on every complex food derivative from a can of Coke to Amy’s organic vegan pizza. It’s a good idea, not new exactly, nor without its issues.

Garbage in; garbage out. Complex and diverse financial products don’t necessarily boil down to the same basic elements the way complex and diverse food products do. It’s not obvious what a check cashing transaction has in common with a secured credit card or an expedited bill payment. I’m guessing the food industry made the same fuss, but ultimately did arrive at some common variables, sodium, sugar, fiber, etc. So this is worth spending time on, but my hunch is that it’s really just a matter of creating simpler products, not just simpler explanation of terms.

Just in time information. A couple years ago, we made a grant to Appleseed to create more transparency for international remittances. A similar Shumer box was proposed. However, we learned that relevant information can be latent (does the exchange rate apply to when the remittance was made, when it was picked up, or when the currency was actually exchanged?). In the case of food, latent nutritional information usually refers to something rotting. But the duration of a financial product can be days, months or even decades, without the product necessarily spoiling.

Context is content. This is an important one: simple factiods may be poor proxies for a product’s real quality. Annual Percentage Rate, for example, can be quite deceiving. Have you ever calculated the APR on your last checking account overdraft? It’s not pretty: handily over 1000%. But an overdraft can serve an important purpose and one people are willing – and rational – to pay for (especially when they choose to do so). APR makes more sense for products that you use over a year. But what about products that you use for a day or a week?

The new fine print. I really hate to be so gloomy, because I love the IDEA of a financial services facts summary, but who reads those nutritional facts anyway? I’ve stared at them, but never, ever “used” one. Let’s say we could answer my qualms, above (and others): who will use the financial facts to their benefit? Some, but not most. Other than having added cost for reporting, how will this really, actually benefit real people?

I say, let’s make more transparent products with simple features. Let’s design them so they reward the manufacturer for their efforts and risk and actually, heaven forbid, create value for people and businesses using them. Let’s communicate clearly about how they work at a level commensurate to the person who will use them (no harm in a 60 page private placement memorandum for a sophisticated investor).