You’re not fully clean unless you’ve tried to get a ZestCash loan, except you won’t have any luck, unless you live in Utah. Former Googler Douglas Merrill and former Cap-Onener Shawn Budde introduced ZestCash today. It’s the latest entrant in the anti-payday online short-term lending space, following suit to Wonga, BillFloat and ThinkFinance’ alternative alternatives (eg. Elastic). Other than figuring out how to source customers in an affordable manner (online payday lead generation has become an expensive undertaking), and managing risk effectively, Zest and its brethren have to figure out how to differentiate themselves to consumers and regulators with a dim view of the payday space.

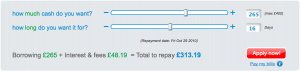

Zest does this today by claiming to be 50% cheaper, longer term, and customized. It’s not dissimilar from UK-based Wonga, in its appeal towards transparency: both give the consumer the ability to choose loan amount and repayment term.

Here’s Zest’s interface:

Here’s Wonga’s interface:

Both still offer loans at high APR and therefore beg the question how they’re substantively different from payday loans. I believe they are substantively “better” than payday loans:

- It’s not about APR. Yes, 100% APR sounds terrible, but ANNUAL Percentage Rate just not an accurate measure for a loan lasting 2 to 24 weeks. I also don’t believe it is inherently harmful to anyone’s financial freedom, relative to the value of instant liquidity against relatively high risk, as long as you clearly understand the terms and have the ability to repay.

- It IS about transparency and ability to pay. The former needs to be true for real people, not lawyers who believe a 2-page disclosure document is better than a 10-page document. The latter (ability) requires the lender to make a reasonable effort to verify you can repay a loan, without needing to roll-over into another loan.

- Fully amortizing. Loans that require full repayment before extending further credit enable a customer prone to credit addiction an important breather.

- Longer term. While longer term loans equal higher risk to lenders, they provide customers more flexibility to pay and smooth their cash-flows. This is good.

- Risk-based. Wonga’s CEO uses the term “selectivity” as an attribute of fairness: he turns down a lot of folks. I think one better is pricing people in smaller risk buckets, so that the lowest risk customers don’t carry the burden of the entire populations’ poor performers, but only that of their risk band.

This is all controversial territory, but without discussing it, we will continue to vilify anything designed to scale and laud efforts which do not meet the insatiable demand. Understanding what are “good” and “responsible” loans requires moving beyond APR. Feel free to disagree.