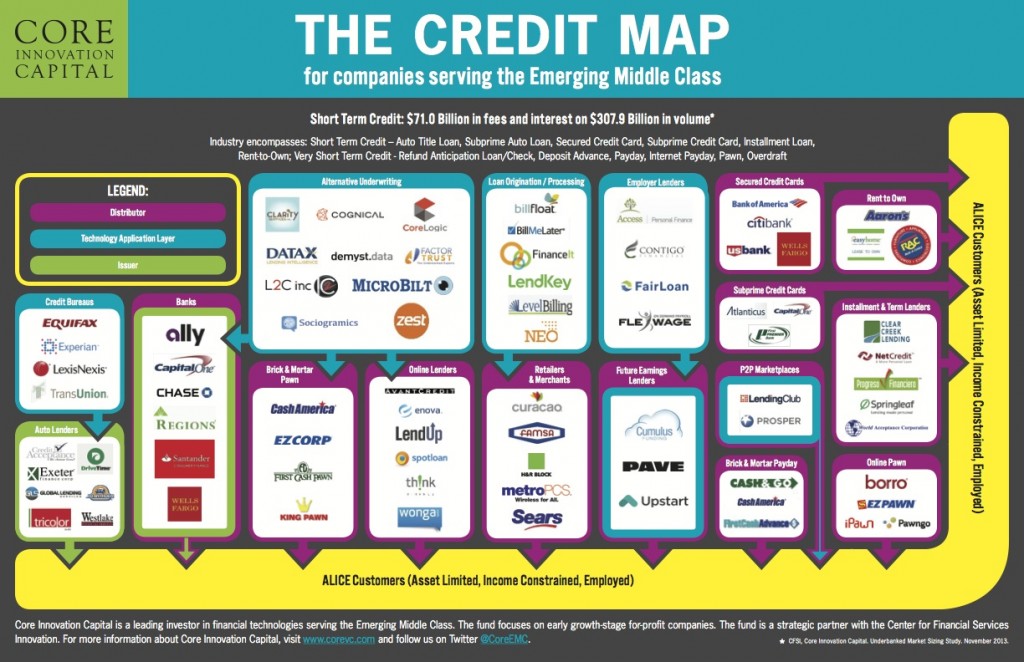

Following the Payments Map of companies serving the Emerging Middle Class, here’s The Credit Map. A handy dandy guide for seeing how all the pieces fit together and a decent sample of who are the movers and shakers. These companies were key in generating $71 billion in consumer revenues in 2012 by issuing approximately $300 billion in various shapes and forms of credit, from auto titles to secured credit cards to pawn and the more out there “future earning lenders” and “employer lenders.” I hope it’s useful.

Who’s here? LexisNexis, Exeter, Tricolor, Westlake, Wells Fargo, Clarity, L2C, FactorTrust, Zest Finance, Regions Bank, BillFloat, LendKey, Neo Finance, Contigo, FairLoan, Aarons, Clear Creek, NetCredit, Progreso Financiero, EZ Pawn, LendingClub, Pave, La Curacao, LendUp, Think Finance, Cash America and EZ Corp, to name a few (and bump my SEO).

The Credit Map serving the Emerging Middle Class. Fascinating! Thank you @CoreVC @ArjanSchutte. http://t.co/tDvj7Ced3z

Check out The Credit Map of companies serving the emerging middle class http://t.co/y6hDsdnILO

#underbanked: The Credit Map: Who’s who for Credit serving the Emerging Middle Class ($71b in revenue) http://t.co/PIYnRERcPc

[…] Middle Class, is the Savings and Financial Capability Map (preceded by the Payments Map and the Credit Map). This is the smallest in terms of generating revenues – only $8.9billion in fees – and contains […]