According to the NVCA financial services represents around 2% of all venture capital investments, in dollars committed. Financial services is small potatoes. Even smaller is the sub-segment of consumer finance for the underbanked. Invisible to most. A charity case or the land of feckless predatory players.

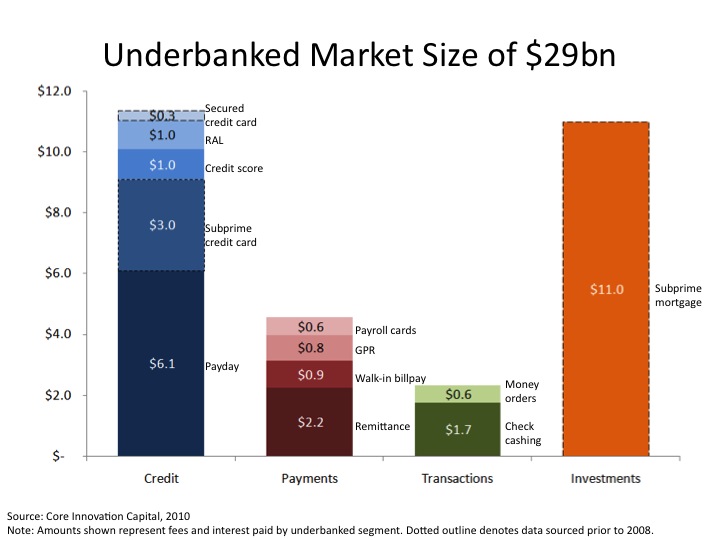

Quite different, in reality. For obvious reasons, we spend some time trying to get a current picture of how much underbanked consumers in the US spend on financial products and services. What kind of money is spent on fees and interest for credit products, like refund anticipation loans and credit scores, for payments like prepaid and remittances, for transactions and investments? The picture below is an estimate, based on the most reliable sources we could find, including substantial data (in the dotted line) that was pre-2008, therefore ancient history. Our estimate reflects recent contractions in remittances and check-cashing, due to higher unemployment, as well as significant growth in products like payday lending and general purpose prepaid. This is highly imperfect – and we want better intelligence if anyone has it – but it is big: $29 billion per year.

Big enough for the best and brightest to spend their time on. Luckily for everyone, it is inefficient enough that greater marginal profits can also yield greater value for lower income people, who pay more for basic financial services of any income segment – from banks as well as AFS. The underbanked segment is an open invitation to merge big profit potential with big social impact, and opportunities to create more financial freedom in America.

Our fund, Core Innovation Capital, is singularly focused on investing in early growth-stage companies in this space.

Nota bene: thanks to our super-intern, Ailian Gan, for doing the work on this