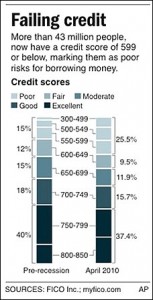

The Washington Post ran an interesting story on some trends in consumer credit scores. Basically, there are more people with low scores and more with high scores. Those with 800+ FICO scores are presumed to have gotten their debt into shape. Those with 599 and below now represent 43 million Americans – up from 26 million. The latter could be due to negligence (not paying bills, overspending) or misfortune (unemployment, tough times).

The Washington Post ran an interesting story on some trends in consumer credit scores. Basically, there are more people with low scores and more with high scores. Those with 800+ FICO scores are presumed to have gotten their debt into shape. Those with 599 and below now represent 43 million Americans – up from 26 million. The latter could be due to negligence (not paying bills, overspending) or misfortune (unemployment, tough times).

For now, most lenders will simply focus on the best risk, as they limit their exposure. However, this also represents the advent for the subprime burueas. Historically, these companies – like Teletrack, CL Verify, and DataX – have only served payday lenders. While payday lenders find their customer demographic moving upstream, more adventurous banks will quickly need to move downstream (on the FICO spectrum, that is). I believe they will increasingly need to rely on these alternative data sources to do so. As the article points out, a FICO score of 580 could be for any number of reasons – some more predictive of someone’s stability, ability and willingness to pay, than others. Additional data will be important to determine if Person A with 580 is actually a 620 and Person B actually 550. Alternative analytics, like L2C, ID Analytics, and LexisNexis’ RiskView, will also become more important.