No one who reads my blog will be surprised to learn that 1 in 4 Americans are underbanked. But I do see quite a few raised digital eyebrows when I point out that these 80 million consumers spend almost $80 billion on fees and interest for the most basic of financial services every year. While most would assume that these enormous fees are generated primarily by check cashers and payday lenders, the actual amount is quite small at $1.7B and $4.8B, respectively. In fact, the lion’s share of these fees derive from subprime auto lending.

Emerging Middle Class Americans paid $27 billion in interest and finance charges for their cars in 2011. $27 billion! That’s over one-third of all financial services expenses incurred by those with imperfect credit or those that rely on alternative financial services. Back of the napkin math works out to just over $300 per person per year. As a point of reference, I pay only one-fifth of that amount.

Is this population, as a whole, really five times more risky than me? While some individuals may be, I would argue that most are not. And I believe this will have dire repercussions for many of today’s subprime auto lenders.

Over the course of this week, I’m going to write a three-part series on this hidden but giant industry within consumer finance. This first post makes the obvious point that it’s large and growing. In the next, I’ll argue that subprime auto lending is the new payday lending – in a good way. And finally, I will make some predictions about how the industry will change in the next five years.

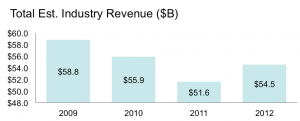

But first, chew on this: auto finance, in its entirety, represents a $55 billion spend category (Experian, 2012). Sub-prime is about half of that and it’s growing fast. The industry is quite profitable: 32% net margins overall, and as high as 40% for “buy here pay here” lenders. After a dip in the recession, consumer demand is up. Big players like JP Morgan are showing renewed interest in the category. And the secondary market is interested.

But first, chew on this: auto finance, in its entirety, represents a $55 billion spend category (Experian, 2012). Sub-prime is about half of that and it’s growing fast. The industry is quite profitable: 32% net margins overall, and as high as 40% for “buy here pay here” lenders. After a dip in the recession, consumer demand is up. Big players like JP Morgan are showing renewed interest in the category. And the secondary market is interested.

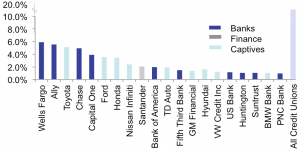

All of this – a large, growing but highly fragmented market with a poorly designed consumer product – leads me to believe that the technology transformation evidenced in the payday industry over the past five years will likewise transform the subprime auto market, which today operates basically as it did 20 years ago. I’ll make the case why in my next post.But it’s curious to note that this giant industry is made up only of small players. No one company commands greater than 6% of the total industry (Wells Fargo leads, Ally – formerly GMAC – is close second). Credit unions, who have long staked their raison d’etre on their great auto finance terms, are 21% of the market. But that’s across 7,000 credit unions. Not even the largest credit union has more than 1% of the total market. Can you say super fragmented?

All of this – a large, growing but highly fragmented market with a poorly designed consumer product – leads me to believe that the technology transformation evidenced in the payday industry over the past five years will likewise transform the subprime auto market, which today operates basically as it did 20 years ago. I’ll make the case why in my next post.But it’s curious to note that this giant industry is made up only of small players. No one company commands greater than 6% of the total industry (Wells Fargo leads, Ally – formerly GMAC – is close second). Credit unions, who have long staked their raison d’etre on their great auto finance terms, are 21% of the market. But that’s across 7,000 credit unions. Not even the largest credit union has more than 1% of the total market. Can you say super fragmented?

All of this – a large, growing but highly fragmented market with a poorly designed consumer product – leads me to believe that the technology transformation evidenced in the payday industry over the past five years will likewise transform the subprime auto market, which today operates basically as it did 20 years ago. I’ll make the case why in my next post.

Subprime Auto Finance: The Hidden Giant: http://t.co/kqkKJbWz3P by @arjanschutte

Subprime Auto Finance: Hidden Giant | Inside the Underbanked http://t.co/xM1nwpx3oQ by @arjanschutte

[…] my last post, I made the case that the financial product no one talks about – auto finance – is […]